Understanding the QRMP Scheme for Small Taxpayers, Get Practical GST Course

The Quarterly Return Monthly Payment (QRMP) Scheme is a simplified GST compliance option introduced by the Indian government for small taxpayers with an aggregate turnover up to ₹5 crore in the previous financial year. This scheme allows eligible businesses to file GSTR-1 (outward supplies) and GSTR-3B (summary tax return) on a quarterly basis instead of monthly, while requiring tax payments to be made monthly through a simple challan system.

Key Features of the QRMP Scheme:

-

Eligibility: Taxpayers with annual turnover up to ₹5 crore in the current and preceding financial year can opt for this scheme. GST Course in Delhi

-

Quarterly Filing: GSTR-1 and GSTR-3B returns are filed once every quarter.

-

Monthly Payments: Tax payment for the first two months of the quarter is made monthly using either:

-

Fixed Sum Method (FSM): A fixed amount (0.5% of previous quarter’s net GST liability or ₹1,000 whichever is higher) can be paid as an advance tax.

-

Self-Assessment Method (SAM): Taxpayers calculate and pay tax based on their actual liability every month.

-

-

Invoice Furnishing Facility (IFF): Under QRMP, taxpayers can upload B2B invoices each month using IFF to facilitate better ITC claim by buyers before the quarterly GSTR-1 filing.

-

Opting In or Out: Taxpayers may opt into or out of the QRMP scheme at the beginning of each quarter through the GST portal.

-

Penalty on Late Filing: Late fees and penalties apply if quarterly returns or monthly payments are delayed or missed.

-

ITC Claims: Input Tax Credit claims are made in the same manner as for monthly filers, ensuring no difference in credit eligibility.

Benefits:

-

Reduces the compliance burden by decreasing the number of returns filed.

-

Improves cash flow management by spreading tax payments monthly, with filing quarterly.

-

Saves time and administrative expenses for small businesses.

-

Provides flexibility with two tax payment options (FSM and SAM).

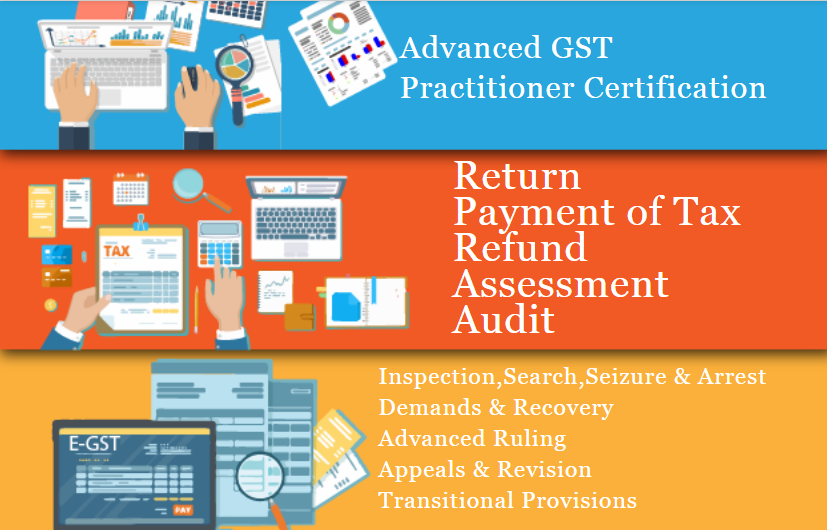

Practical GST Course in Delhi 110008 by SLA Consultants India:

SLA Consultants India offers a comprehensive practical GST course focusing on the QRMP scheme tailored for small taxpayers. The course covers:

-

Eligibility criteria and opting process for QRMP.

-

Step-by-step filing of quarterly GSTR-1 and GSTR-3B returns.

-

Monthly tax payment methods (FSM and SAM) and challan generation.

-

Use of Invoice Furnishing Facility (IFF) for monthly B2B invoice uploading.

-

Handling penalties, compliance best practices, and GST portal demonstrations.

-

Real-time case studies and reconciliation techniques to avoid errors.

This practical training equips professionals, entrepreneurs, and students in the Delhi 110008 area with hands-on skills to manage GST returns efficiently under the QRMP scheme and ensures seamless compliance with GST laws.

In summary, the QRMP scheme simplifies GST return filing for small taxpayers by enabling quarterly returns combined with monthly tax payments, reducing paperwork and easing compliance. SLA Consultants India’s course provides the necessary guidance and practical expertise to master this scheme professionally.

SLA Consultants Understanding the QRMP Scheme for Small Taxpayers, Get Practical GST Course in Delhi, 110008, by SLA Consultants India, New Delhi, details with New Year Offer 2025 are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

E-Accounts, E-Taxation and (Goods and Services Tax) GST Training Courses

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar, New Delhi,110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/