Difference Between GSTR-1, GSTR-2 and GSTR-3B, Get Practical GST Course in Delhi

Here is a clear and concise explanation of the differences between GSTR-1, GSTR-2, and GSTR-3B, along with information about practical GST training in Delhi.

GSTR-1: Outward Supplies Return

-

Purpose: Reports all outward supplies (sales) made by a registered business.

-

Details Included: Invoice-level data of sales to other businesses (B2B) and consumers (B2C), including invoice numbers, dates, HSN/SAC codes, taxable values, and customer GSTINs.

-

Filing Frequency: Monthly for businesses with turnover above ₹1.5 crore (or ₹5 crore for QRMP eligibility), or quarterly for smaller businesses. GST Course in Delhi

-

Impact: Ensures that sales data matches the recipient’s purchase records, enabling accurate Input Tax Credit (ITC) claims by buyers.

GSTR-2: Inward Supplies Return (Suspended)

-

Purpose: Was intended to report all inward supplies (purchases) and claim ITC.

-

Current Status: Filing of GSTR-2 has been suspended since September 2017 due to complexity and implementation issues.

-

Replacement: Now, GSTR-2A (auto-populated from supplier’s GSTR-1) and GSTR-2B (static monthly ITC statement) are used for ITC reconciliation and verification.

-

Note: GSTR-2 is not currently active, but understanding its original intent helps clarify the GST return framework.

GSTR-3B: Summary Return

-

Purpose: Provides a summary of both outward and inward supplies, ITC claimed, and net tax payable for the period.

-

Details Included: Summary-level data (not invoice-level), self-assessed by the taxpayer.

-

Filing Frequency: Monthly for most taxpayers, or quarterly for small taxpayers under the QRMP scheme.

-

Tax Payment: Tax liability is paid at the time of filing GSTR-3B.

-

Importance: Serves as an interim measure for tax payment and compliance, ensuring timely declaration and payment of GST.

Key Differences Table

| Feature | GSTR-1 | GSTR-2 (Suspended) | GSTR-3B |

|---|---|---|---|

| Purpose | Outward supplies (sales) | Inward supplies (purchases) | Summary of sales, purchases, and tax payment |

| Frequency | Monthly/Quarterly | Not applicable | Monthly/Quarterly |

| Detail Level | Detailed, invoice-level | Not applicable | Summary, self-declared |

| ITC Reporting | Not applicable | Not applicable | ITC claimed and paid |

| Status | Active | Suspended | Active |

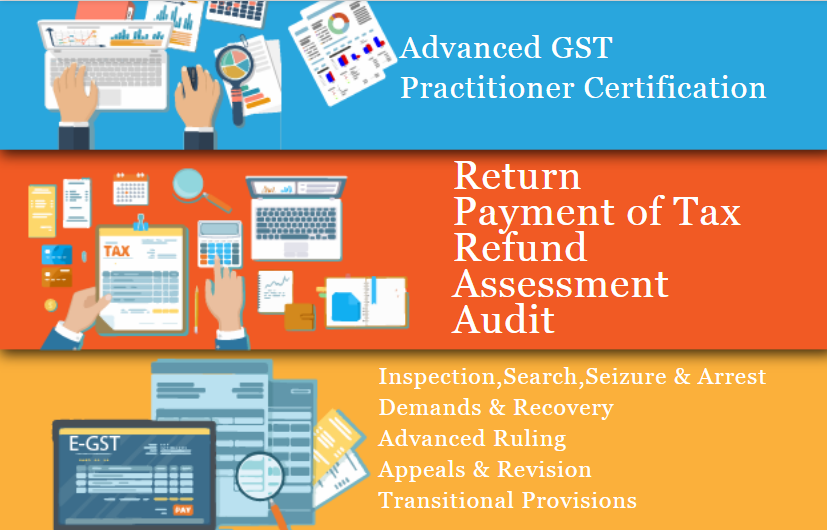

Practical GST Course in Delhi by SLA Consultants India

SLA Consultants India, located in New Delhi (110032), offers a practical GST course that covers all aspects of GST return filing, including GSTR-1, GSTR-2A/2B, and GSTR-3B. The course provides hands-on training, real-world case studies, and step-by-step guidance, helping businesses and professionals master GST compliance and stay updated with the latest regulations9.

By understanding and managing these returns, businesses can ensure accurate tax reporting, maximize ITC benefits, and maintain a strong compliance record under the GST regime.

SLA Consultants Difference Between GSTR-1, GSTR-2, and GSTR-3B, Get Practical GST Course in Delhi, 110032, by SLA Consultants India, New Delhi, details with New Year Offer 2025 are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

E-Accounts, E-Taxation and (Goods and Services Tax) GST Training Courses

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar, New Delhi,110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/