Importance of Timely GST Return Filing and Its Impact on ITC, Get Practical GST

Importance of Timely GST Return Filing and Its Impact on ITC

The Goods and Services Tax (GST) system has redefined the taxation landscape in India. One of the critical aspects of GST compliance is the timely filing of GST returns. Timely filing not only ensures compliance with the law but also has a direct impact on the Input Tax Credit (ITC) a business can claim.

Impact on ITC

Input Tax Credit (ITC) allows businesses to reduce the tax they pay on inputs (purchases) from the tax they collect on outputs (sales). The correct and timely filing of GST returns plays a crucial role in ensuring businesses can claim the ITC they are eligible for. If the returns are filed late, the ITC claimed by the business may be blocked or delayed, which could lead to additional financial burdens.

GST law mandates that businesses can claim ITC on the purchase of goods and services only if the supplier has filed their GST return. If the supplier fails to file their return on time, the purchaser cannot claim the ITC until the supplier complies with the filing requirements. This creates a significant cash flow issue for businesses, as they are unable to utilize the input tax credit they are entitled to, leading to an increase in working capital needs.

Penalties for Late Filing

The GST law imposes penalties for late filing of returns. Businesses that fail to file their returns within the due date can face late fees, interest charges, and even the suspension of their GST registration in extreme cases. The late fees are calculated based on the turnover of the business, and the longer the delay, the higher the penalties. Therefore, timely filing of GST returns helps businesses avoid these extra costs and stay compliant with the law.

Practical Course in Delhi on GST

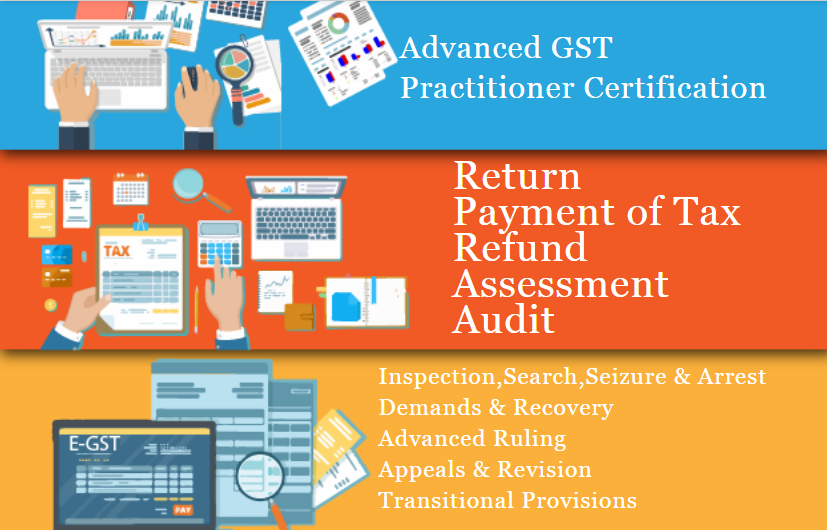

For those looking to master GST compliance, including timely filing of returns and understanding the nuances of ITC, SLA Consultants India in New Delhi offers a Practical GST Course in Delhi. This course is designed for individuals, accountants, and business owners who wish to gain a thorough understanding of GST operations, including filing returns and managing ITC claims effectively.

The course is tailored to provide hands-on training in GST return filing, understanding the provisions of GST, and its impact on business operations. With the course’s expert guidance, participants can ensure they remain compliant with GST regulations, minimize penalties, and optimize their ITC claims. The course is conducted in New Delhi (110035), making it easily accessible for local businesses and professionals seeking to enhance their expertise in GST.

Conclusion

Timely GST return filing is crucial for businesses to avoid penalties and ensure they can claim the ITC they are entitled to. By enrolling in a practical GST course, like the one offered by SLA Consultants India in New Delhi, businesses and professionals can gain the knowledge and skills necessary to navigate the complexities of GST compliance, reduce financial risks, and improve operational efficiency.

SLA Consultants Importance of Timely GST Return Filing and Its Impact on ITC, Get Practical GST Course in Delhi, 110035, by SLA Consultants India, New Delhi Details with “New Year Offer 2025” are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

GST Training Courses

Module 5 – Customs / Import and Export Procedures – By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi – 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/